Potential Crude Customer FAQs

How do I initiate the online registration process?

- From the https://estream.eprod.com login page, click on the "New Crude Customer" link and follow the instructions provided to initiate the online registration process.

-

To initiate the registration process, you will need to:

- Enter and confirm your email address

- Prove that you are not a computer robot by passing the Captcha test

- Accept the terms and conditions of use

After completing the steps above and clicking the Send button, you will receive an email at the email address provided titled "Enterprise Counterparty Registration - Start the Registration Process" with instructions and link at the bottom of the email to "START" the registration process.

What are the supported Browsers for this site?

- Browsers supported at this time are Google Chrome, Microsoft Edge, Firefox, and Safari.

- IE is not supported.

My link has expired, how do I obtain a new one?

- The link in the "Start the Registration Process" email expires after 24 hours.

- If you have not started your request before the link expires, you will need repeat the steps above to obtain a new "Enterprise Counterparty – Start the Registration Process" email to begin the initiation process again.

Can I update my application after I have submitted it?

- Once "submitted', your application is locked pending review and approval. You cannot access it by obtaining a new link. Please do not submit additional applications.

-

Once your application is reviewed, the application administrator will either:

- Request more info via email using an email titled "Enterprise Counterparty Registration - More Info Needed". Please respond to these request using the email address provided the application. Failure to respond in a timely manner may result in your application being rejected requiring you to begin start the process again, from scratch.

- Approve your application. If your application contains all of the information needed to verify your business and the data provided in the request, and if approved by the application administrator, you will receive an email from Estream titled "Estream user account created for username".

- Reject your application, requesting updates to required information and/or forms. In this case, you will receive an email with specific instructions on changes required, along with a link to the Portal Website that will allow you to modify your application and/or documents and resubmit to Enterprise for review again.

Completing the online registration forms

Step 1: Select Account Type

What type of account can I register for?

- Currently, the registration process only supports new Crude Walk-up Shipper Accounts.

Step 2: Taxpayer Identification and Certification

Where can I obtain information on how to complete a W9 and W8?

The IRS.gov website contains specific instructions on how to complete both the W9 and W8.

What is the difference between a W9 & W8?

- W9 is used for US domestic tax reporting information, while a W8 is used for foreign tax reporting information.

What is the difference between a W8 BEN & W8 BEN-E?

- International Individuals should use the W-8BEN if claiming beneficial Ownership for US tax withholding and reporting.

- International Entities should use the W-8BEN-E if claiming beneficial Ownership for US tax withholding and reporting.

How do I know which one to use?

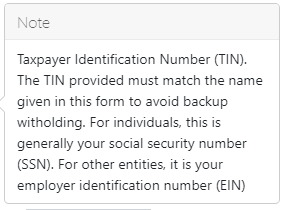

- Use the W9 if a US individual or entity (including resident aliens) to provide your correct TIN.

- Use the W-8BEN if claiming beneficial Ownership for US tax withholding and reporting (Individuals).

- Use the W-8BEN-E if claiming beneficial Ownership for US tax withholding and reporting (Entities).

When must I provide a FTIN (Foreign Tax Identifying Number) when submitting a W-8BEN?

- As of 1 January 2018, US Internal Revenue Service (IRS) regulations require that if you are completing the Form W-8BEN as a non-US taxpayer, the form must include your foreign tax identifying number (foreign TIN) to be deemed complete. Your foreign tax identifying number is issued to you by the country where you pay taxes.

What is the difference between Business Name, DBA, and Disregarded Entity?

- Business Name that you provide should match what is shown on your income tax return. It is typically entered on line 1 of the W9 form.

- DBA stands for "Doing Business As" and identifies trade names, assumed names. In this fictitious example the business name would be "Smith's General Services, Inc." where the DBA name might be "Smith's Shipping". The DBA Name is typically entered on Line 2 of the W9 form.

- A Disregarded Entity is refers to a business entity with one owner that is not recognized for tax purposes as an entity separate from its owner. The Disregarded Entity name is also typically entered on Line 2 of the W9 form.

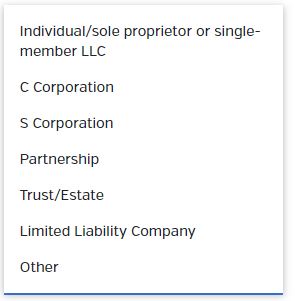

Where do I find my Federal Tax Classification?

- Your federal tax status was assigned when you registered for your EIN with the Internal Revenue Service (IRS). If you do not know your tax classification please log onto http://IRS.gov for assistance.

Where do I find my EIN (Employee Identification Number)?

- Your EIN is the number assigned to you by the Internal Revenue Service (IRS). If you do not know where to find your number you can call the IRS 800-829-4933.

- If you have lost or misplaced your EIN please contact the IRS: https://www.irs.gov/businesses/small-businesses-self-employed/lost-or-misplaced-your-ein

What address do I use for my taxpayer identification?

- Use the address listed on your tax forms.

Why am I being asked to complete DocuSign?

- Docusign allows us to you to complete your forms online and sign them electronically. No more having to print, complete, and then fax or mail back!

Is Docusign a legal method for Signing Forms?

How do I sign a document using Docusign?

To simplify the form submittal for tax identification documents, some of the information that is entered via the web portal during the application process will be programmatically transferred over to the W8 and W9 tax documents for you.

Important note: You will have to make appropriate selections to properly complete your tax id forms according to IRS instructions for those forms. Please review these instructions prior to filling out your tax forms to ensure that they are properly completed. Incorrect or incomplete forms will cause your application to be rejected.

- Click on "Continue" at the top of the form.

- Complete all required and optional fields as necessary.

- Click

and Docusign generates an electronic signature.

and Docusign generates an electronic signature. - You may also print a copy of the signed document at this time.

- Click on "Finish" to submit the document.

- At this point, you will receive a copy of your signed document via email from DocuSign.

Will I get a copy of my documents once signed?

- You will receive an email with a copy of all your signed documents once you have signed and finished the Docusign process.

Step 3: Counterparty Company Details

What is a DUNS Number and why is it being requested?

- A DUNS number is a unique number assigned to an Entity by Dun & Bradstreet (D&B) who provides services to companies to verify business data.

- If your business has a DUNS number, please provide it as part of the application. If you do not, please leave this information blank.

- If you need to look up your DUNS number, please see the https://www.dnb.com/duns-number/lookup.html website.

Why must I provide a remittal email address?

- The remittal email is used for correspondence related to accounting/financial transactions.

- If you do not have a specific designated remittal address, use the Same As primary checkbox.

Does it have to be my email address?

- It should an individual's company-assigned email address. This should not be a shared mailbox.

What's a Parent Company?

- A parent company is a company that has a controlling interest in another company, giving it control of its operations. If you do not have a parent company, please do not select the check box.

What is "Contact" account and how is it used?

- Contact Accounts provide contact information for individuals responsible for various roles in your organization.

- Type of accounts include: Commercial, Credit, Contract/Legal, Accounting and Scheduling.

- Information needed includes: First Name, Last Name, Job Title, Mobile Phone and Email Address.

- Adding someone as a contact does not automatically provision an Enterprise account for them. Contact accounts instead provide Enterprise with the ability to work with individuals either via email or cellphone to conduct business with Enterprise.

What is a "User" account and how is it used?

- When you add a contact to the list above, if that contact requires a login to the Estream System, then indicate so by selecting "Yes" for the "Account Needed?" question.

- User Accounts (logins) will be provided for individuals to access the Estream system in order to conduct business on the Crude system.

- Currently, the registration portal only supports requests for "Scheduling" account types.

- You must have a minimum of one contact with a scheduling role to submit your registration request.

Step 4: Banking Information

Why do you need Company banking information?

- Payment via electronic funds transfer is the safest way to ensure your payment is received.

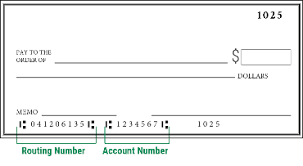

What is the difference between ABA and Routing numbers?

- An ABA number is the same as your routing information. It is a 9 digit number and is specific to your bank.

Why do you need an Owner/Officer signature for banking?

- This is a security requirement required by Enterprise Products and affiliates in attempts to prevent or limit fraud.

What is a Swift?

- A SWIFT code is an international bank code that identifies particular banks worldwide. It's also known as a Bank Identifier Code (BIC). CommBank uses SWIFT codes to send money to overseas banks. A SWIFT code consists of 8 or 11 characters.

What if I don't have a Swift?

- Unless you are doing International banking you will not need this information. Leave the field blank if you do not have a SWIFT number.

What is an IBAN?

- You can find your International Bank Account Number (IBAN) and Bank Identifier Code (BIC or SWIFT) on your paper statement or by logging in to Online Banking.

What if I don't have an IBAN?

- Unless you are doing International banking you will not need this information. Leave the field blank if you do not have an IBAN number.

Why do you need information on an Intermediary Bank?

- For Intermediary Banking needs please provide the bank name, address, aba/routing number, and For Further Credit (FFC) information. If you do not require an Intermediary Bank, do not add one.

Step 5: Additional Documentation

Why can I only upload PDF files?

- This is a security precaution to prevent viruses from being transferred with any documents uploaded.